Sestry Peremohy

A partner

to help you thrive

Daintree.VC was started by Nick Day, a founding partner in Velocity Black , acquired by Capital One in 2023.

Press release can be found here

Latest news from our portfolio

Tenacity and hustle

Daintree.VC is a venture capital fund, supporting founders who do not back down.

FAQ

Ask one of our portfolio founders! We try to be the most active, helpful and responsive investor on your cap table. We are always there for you.

We focus on pre-seed and seed stage investing. Time to time, we invest into later stage rounds through convertible notes or secondaries.

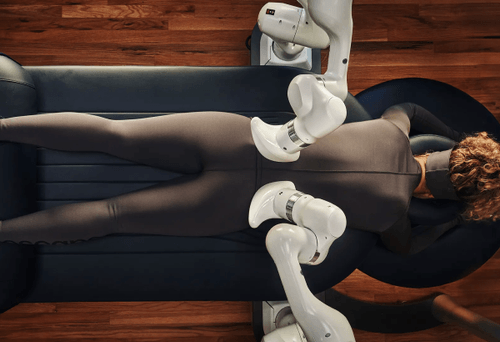

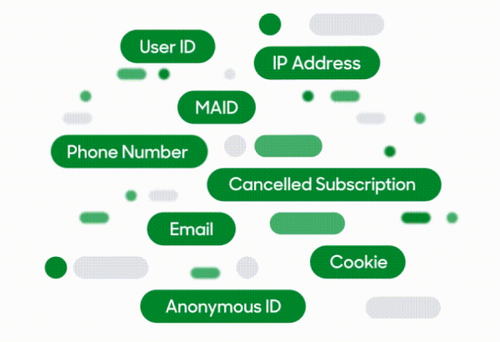

Our portfolio centres around financial inclusion, wellbeing and enterprise automation.

It is never too early to get in touch. We have invested in companies with nothing more than a PowerPoint.

We invest in ~10 businesses a year.

Yes, we love B2B.

We invest across Europe, the U.S., and Latin America.

Our focus lies in your spiritedness, thoughtfulness, vision, and tenacity, not simply your CV. Of course, we also look at factors such as unit economics, market size, and competitor landscape of your business.

We are fast movers. It takes between 1 and 4 weeks from pitch to signed documentation.

Normally we do not lead investment rounds ourselves.